Spectacular Info About How To Find Out Mello Roos

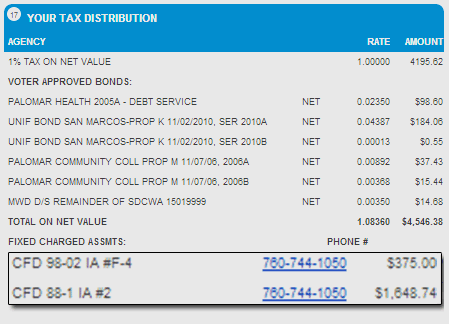

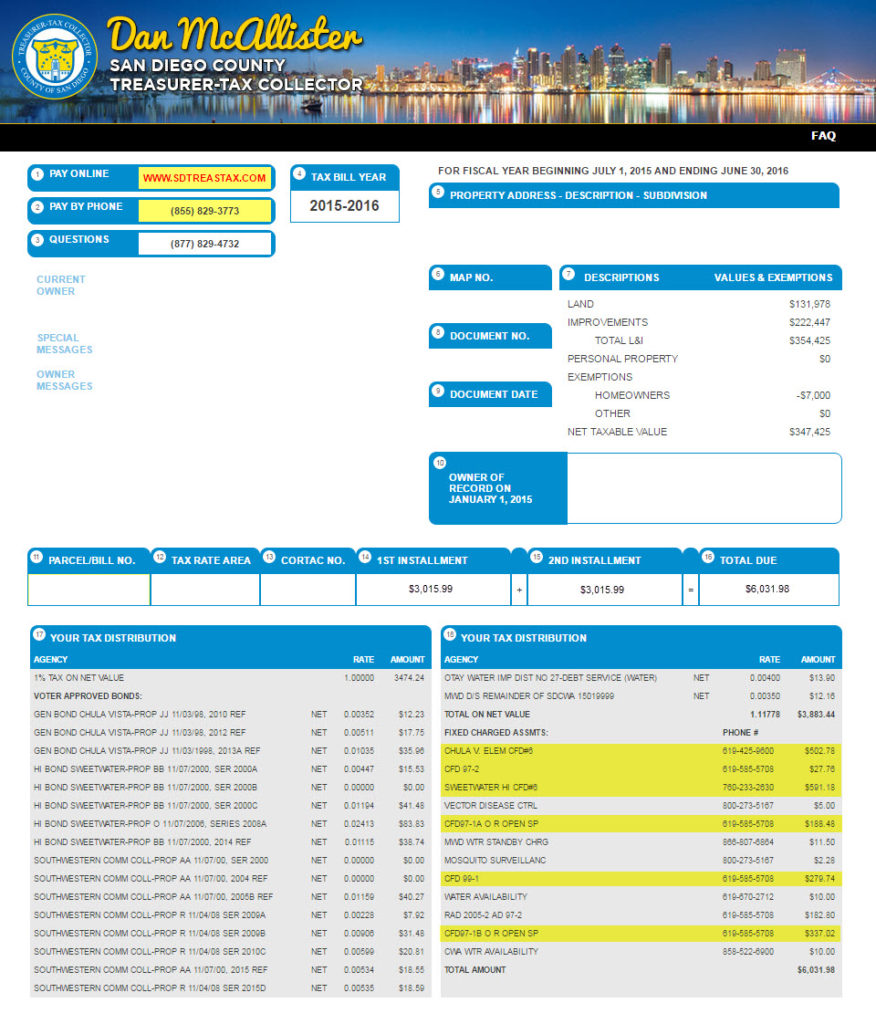

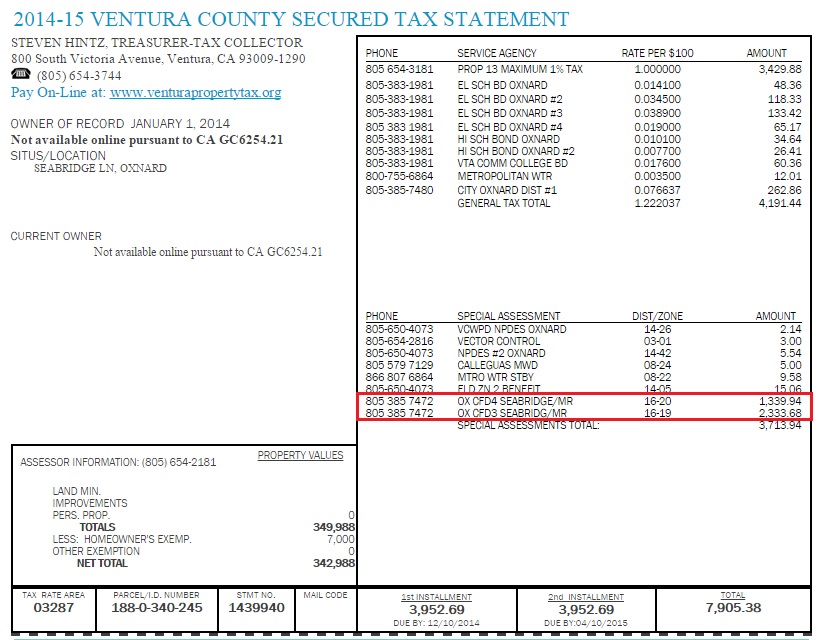

Sometimes these assessments are cfd’s (community facility district tax).

How to find out mello roos. If you have any questions about a mello roos fee, please call the taxing. Find out if a home has mello roos here: You won't find mello roos in every state, but you will in california, so if you’re planning to live in this great state, it’s best to understand what they are and how they might impact you before.

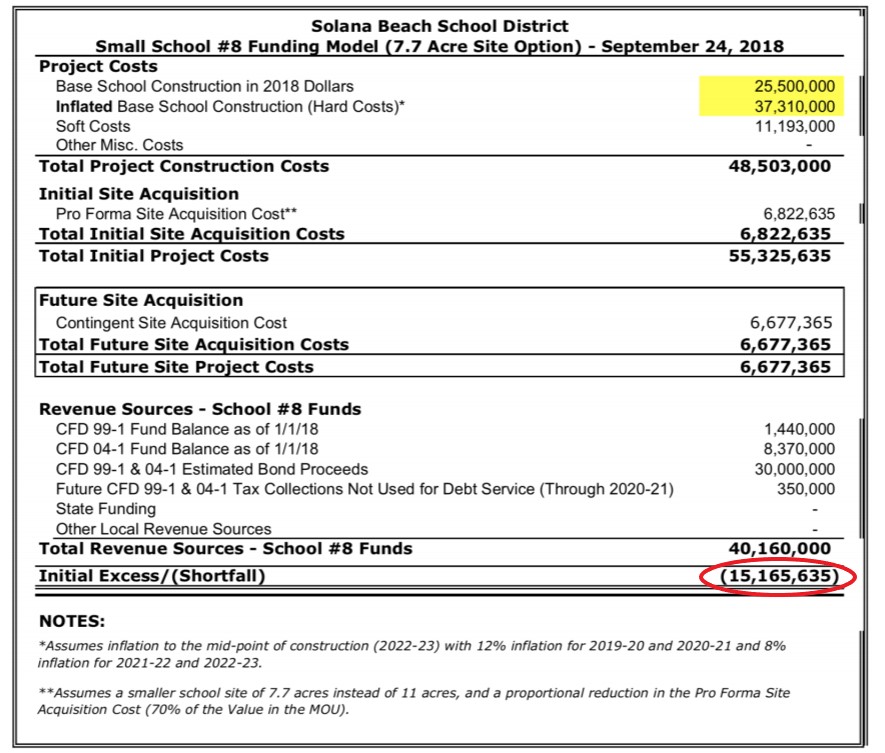

Soooooo i dud further and found out that you may obtain mello roos information from your title. These types of bonds are normally issued for 30 years and will be billed as part of your property taxes. 5941224000 the only fees which are valid mello.

Calculate your mello roos tax by looking at your current property tax bill. A written and signed request by two members of either the local government or school district, a signed. You have to contact your tax accessors office.

However, the mello roos information is not free and they charge $29. Find your property’s parcel number in the middle of your tax bill, or find it by searching your address on the san diego county clerk’s. See what you are paying in mello roos tax, and then divide that amount by your property’s value.

They should have the number to contact for info on special accessements like mello roos. Go to services, then click on view fixed charge special assessments (last one in center), then enter the apn try this apn: